Retail stores sell merchandise for prices that are usually much less than they paid for the inventory, so their ratio is high. Small retail companies and stores often have a higher asset turnover ratio because they typically generate a large number of sales relative to the cost of their assets. The asset turnover ratio is effective at comparing businesses in the same sector, but it is not meaningful when comparing businesses that operate in different industries. A higher asset turnover ratio is typically seen as better, as it indicates that the company is able to more efficiently produce profits based on their available inventory. For example, an asset turnover ratio of 0.50 indicates that the company in question is able to convert every dollar of assets into 50 cents worth of revenue. The formula was first used in the 1920s as part of the Dupont company's analysis and has become an industry standard since then. The asset turnover ratio is a mathematical function that calculates how efficiently a company converts assets into revenue.

Related: 3 Methods for Classifying Tangible Assets What is the asset turnover ratio?

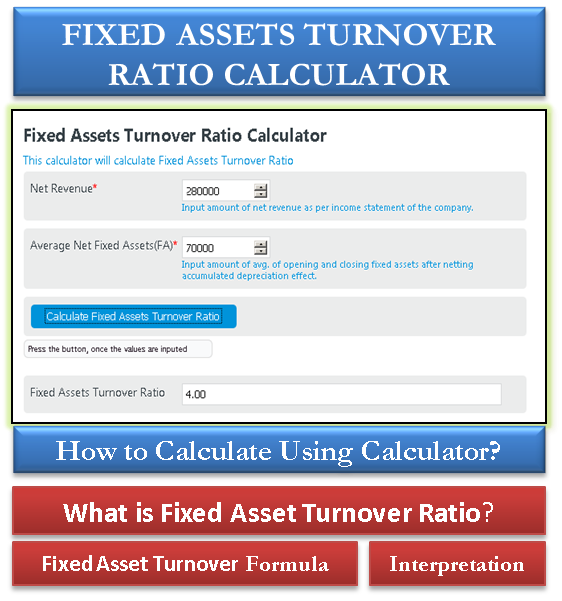

#CALCULATE ASSET TURNOVER HOW TO#

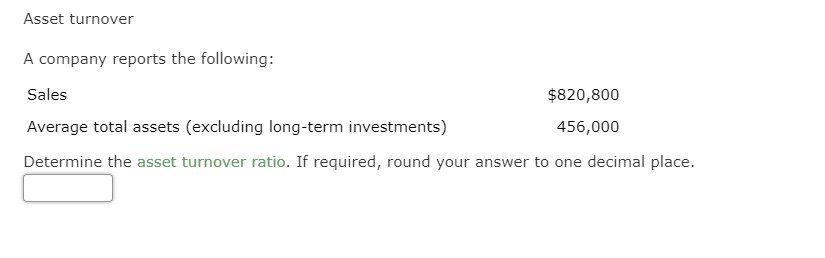

In this article, we discuss how to use the asset turnover formula to calculate asset turnover ratio, with examples. This ratio is known as the asset turnover ratio. When looking at profits, many accountants analyze the ratio between each dollar of assets compared to each dollar of sales. Furthermore, it isn’t always possible in practice to clearly match a company’s sales and profits to specific investment projects.Understanding how a business converts assets into revenue can be helpful if you want to learn about how the business operates. As ROI refers to a specific period under consideration, it is difficult to compare investments with varying terms.These include economic and market risks, customer satisfaction, and competition. Investment risks and external influence factors aren’t taken into consideration when using ROI.ROI is not suitable for evaluating future investment projects. ROI is a book-value based indicator that generally only allows conclusions to be drawn about the past.Flaws emerge both in the analysis of the company’s overall results as well as in the evaluation of single investments. When it comes to describing financial implications, however, the ROI itself has limited informative value: when considering individual cases, repercussions within the overall context can fall by the wayside. The indicator is quickly determined and also implies reproducibility. It generates a ROI that refers to a specific profit share and the advertising costs that were spent to obtain it.Ĭalculating ROI is considered one of the standard procedures for evaluating investment projects, both in forecasts and in the subsequent performance review.

To do this, you can use the ROAS formula (return on advertising spend). You can calculate the success of your marketing investments by dividing the profit share by these advertising costs and multiplying the result by 100. The AdWords advertisements incur an expense of 500 dollars. For the purchase of articles, you incur a cost of 2,500 dollars which you use to generate 4,000 dollars in sales. Imagine that you operate an online store and that you advertise your products in the search engine. The following example shows how to do this. Google recommends that website operators measure the success of advertising expenditures for AdWords advertisements by using the ROI it generates. In this context, it is referred to specifically as the return on marketing investment (ROMI). These types of calculations are used in online marketing, for example, in order to figure out the success of advertising costs in relation to the profit they generate.

0 kommentar(er)

0 kommentar(er)